If you’re running a business as an LLC, you might be wondering whether converting to an S Corp could be beneficial. It’s a common question, and making this switch can have a significant impact on your business. Here’s what you need to know about converting an LLC to an S Corp, along with the advantages and disadvantages of doing so.

1. Understanding the Basics

Before diving into the pros and cons, it’s important to understand what each entity is.

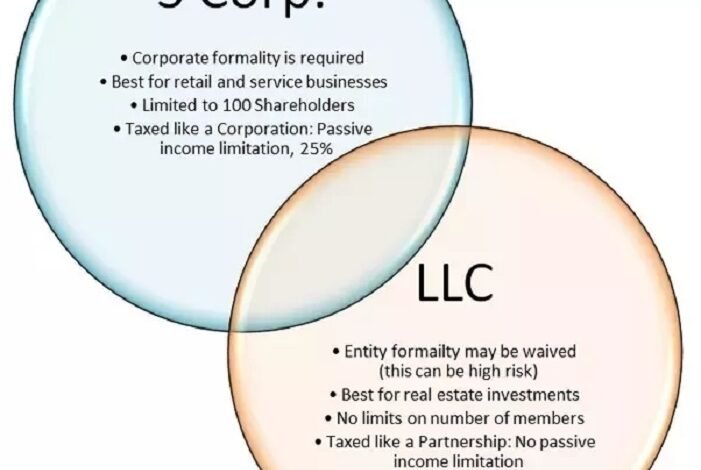

- LLC (Limited Liability Company): An LLC provides limited liability protection, meaning your personal assets are protected from business debts. It’s a flexible structure, and profits pass through to the owners’ personal tax returns.

- S Corp (S Corporation): An S Corp is not a business entity itself but a tax designation that you can choose for your LLC. It also offers limited liability protection but has a different tax structure.

2. Advantages of Converting an LLC to an S Corp

Tax Savings

One of the main reasons business owners convert their LLC to an S Corp is for tax savings. In an LLC, all profits are subject to self-employment taxes. However, in an S Corp, only the salary you pay yourself is subject to these taxes, while the remaining profits are distributed as dividends and are not subject to self-employment taxes.

Attracting Investors

S Corps can be more appealing to investors because of the structure and tax benefits. If you’re looking to grow your business and bring in outside investment, converting to an S Corp might be a strategic move.

Credibility

Operating as an S Corp can sometimes add credibility to your business. It’s seen as a more formal structure, which can be beneficial when dealing with clients, suppliers, and other business relationships.

3. Disadvantages of Converting an LLC to an S Corp

Increased Paperwork and Complexity

One of the drawbacks of converting to an S Corp is the increase in paperwork and regulatory requirements. S Corps have stricter rules about ownership, must hold regular meetings, and must maintain detailed records, which can be burdensome for some small businesses.

Salary Requirements

As an S Corp owner, you are required to pay yourself a “reasonable salary” before taking any distributions. This means you have to justify your salary to the IRS, and underpaying yourself could lead to penalties.

Limited Flexibility in Ownership

S Corps have restrictions on ownership. For example, they cannot have more than 100 shareholders, and all shareholders must be U.S. citizens or residents. Additionally, S Corps can only issue one class of stock, which might limit your ability to structure your business as you wish.

4. How to Convert Your LLC to an S Corp

If you’ve weighed the pros and cons and decided that converting to an S Corp is right for you, the process is fairly straightforward:

- Check Eligibility: Ensure your LLC meets the requirements to become an S Corp, including having fewer than 100 shareholders and only issuing one class of stock.

- File Form 2553: Submit IRS Form 2553 to elect S Corp status. This form must be filed within two months and 15 days after the beginning of the tax year you want the election to take effect.

- Adjust Your Payroll: Set up a payroll system to pay yourself a reasonable salary, as required by the IRS.

- Maintain Records: Begin maintaining the necessary records and holding regular meetings as required for an S Corp.

Conclusion

Converting an LLC to an S Corp can offer significant tax savings and other benefits, but it’s not without its challenges. It’s important to carefully consider the advantages and disadvantages before making the switch. If you’re unsure, consulting with a tax professional or business advisor can help you make the best decision for your specific situation.